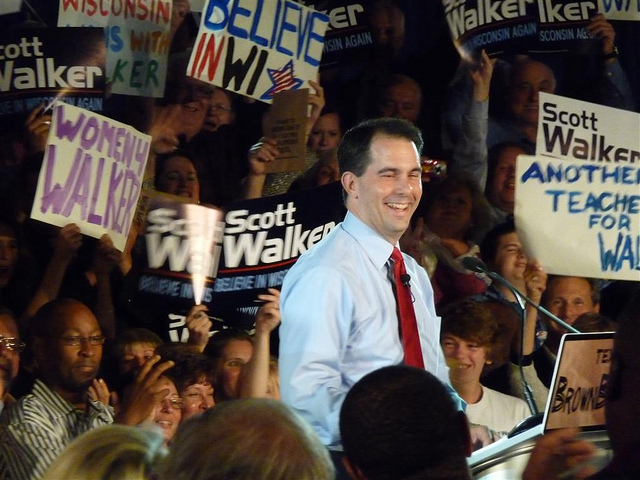

Americans for Tax Reform director of state affairs Patrick Gleason wrote an op-ed in Forbes highlighting Wisconsin Governor Scott Walker’s opponent, Mary Burke, who has been misleading her supporters with falsehoods about Gov. Walker’s tax policy.

Gov. Walker signed $650 million worth of income tax cuts into law in 2013, reducing all rates and consolidating the state personal income tax from five income tax brackets to four. Contrary to what Burke claims, low and middle income Wisconsin households actually saw the greatest relief from Walker’s 2013 tax cuts. The top rate was only reduced by one percent, whereas the bottom three tax brackets were reduced by anywhere from three to five percent.

Mike Godfrey of Tax-News.com wrote an article regarding a coalition letter sent to the House Ways and Means Committee and the Senate Finance Committee, discouraging members from short-term tax reform measures.

The coalition, including such associations as Americans for Tax Reform, National Taxpayers Union, R Street Institute and Americans for Prosperity, pointed out that, “while the clock is running out on the legislative calendar for 2014, with the August recess fast approaching and the midterm elections around the corner,… there’s still not much taxpayers are seeing out of Congress on comprehensive tax reform.

Wall Street Daily ran a piece by Floyd Brown discussing “Cost of Government Day,” an initiative developed by Americans for Tax Reform’s Cost of Government Center.

Now, the Cost of Government Day had never fallen past June 27 before our current president’s tenure. But for the sixth consecutive year, it’s fallen in July.

This time, the official date was July 6, as calculated by Americans for Tax Reform.

In 2014, the government’s share of GDP has climbed over 50%. Our backpacker (the economy) can’t regain his momentum, and he’s struggling to make progress. You’ve probably noticed that the economy has been unable to reach pre-2008 growth levels. Instead, we’re having difficulty growing productivity, employment, corporate earnings and personal income.